Understanding University Endowments in California

Ah, the mysterious world of university endowments in California! Picture this: university endowments are like a magical treasure chest that keeps on giving to support various aspects of academic life. But how do these endowments actually work in the sunny state of California?

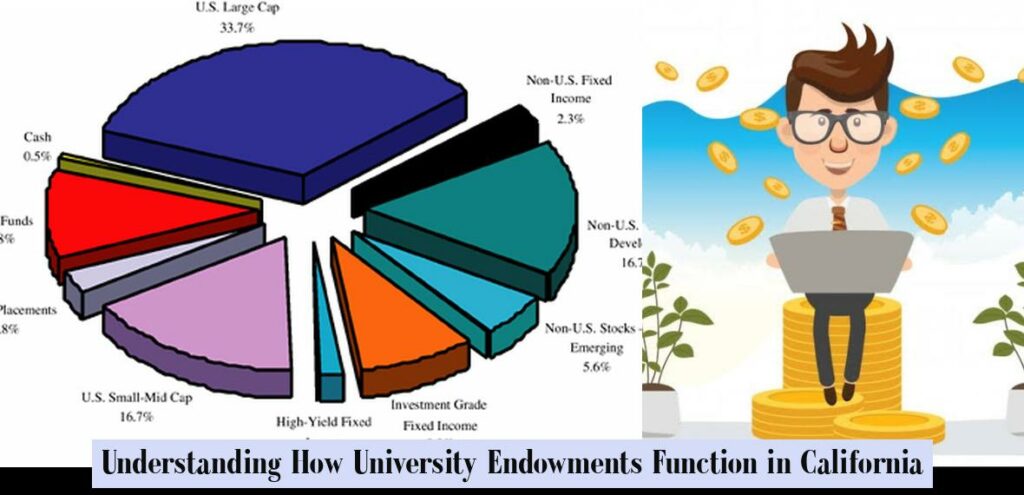

Let’s break it down for you: In California, universities manage their endowments through unitized investment pools. Each individual endowment holds units in this pool, which are revalued monthly. The value of these units at the month-end determines whether new endowments can join the pool. It’s like a financial dance party where every move is carefully calculated.

Now, here comes the tricky part – withdrawing money from the corpus, aka “invading the corpus,” is generally a no-go, unless the board gives a thumbs-up. It’s like trying to sneakily take a cookie from the jar without mom knowing – not cool!

Ever wondered how Stanford spends its massive $36.5 billion endowment? Well, they use it for pretty much everything – faculty salaries, research endeavors, and even athletics! It’s like having a shiny piggy bank that funds all your favorite university activities.

Curious about UCLA’s financial muscle? Brace yourself because as of 2023, they boast an impressive $7.7 billion endowment fund. That’s some serious cashola!

Now onto types of endowments – ever heard of quasi, true, and term varieties? According to financial standards wizards, these are the most common types out there. It’s like choosing between different flavors at an ice cream parlor – each one offering something unique.

But wait, there’s more! Endowments provide universities with a steady stream of income to fuel their teaching and research missions. Think of it as a supportive friend who always has your back financially.

So next time you hear about university endowments in California, remember that they’re not just numbers on paper – they’re lifelines for academic excellence and growth. Stay curious and dive deeper into how these financial wonders shape the landscape of higher education in the Golden State! And hey…keep reading to uncover more exciting insights ahead!

| Endowment | $7.7 billion (2023) |

|---|

The Importance of Endowments to Universities

Endowments are a crucial lifeline for universities, acting as ongoing financial support to fuel their short and long-term goals. Universities like Harvard utilize returns from their endowments to drive financial aid initiatives, research breakthroughs, and faculty sponsorships. These funds basically act as the universities’ version of a magic money tree that keeps on giving!

Now let’s delve deeper into the purpose behind university endowments. The main goal is to generate investment income by strategically investing the donated capital. A portion of this income is used for day-to-day operations, while the remainder is reinvested to ensure sustained growth and support over time. It’s like planting seeds in a money garden and watching them blossom into vibrant financial blooms.

When donors contribute towards an endowment, they can often specify how and when the institution can tap into these funds. This creates a sense of security for both the donor and the university, ensuring that resources are allocated according to their intentions. These designated gifts are like personalized financial roadmaps guiding universities towards their desired destinations.

Despite the invaluable role of endowments, some criticisms have been voiced regarding their size and management, particularly for elite institutions like Harvard. Large endowments have been likened to hoarding in times of rising tuition costs, leading to questions about their utility and allocation strategies during economic downturns. Researchers have highlighted a shift towards prioritizing endowment health over holistic institutional well-being, sparking debates on the appropriate balance between reserves and operational needs.

In essence, endowments aren’t just about accumulating wealth; they serve as strategic tools for universities to sustainably fund critical activities across education, research, and innovation realms. They embody a delicate dance between preserving capital for future generations while leveraging investment returns to bolster present-day endeavors. So next time you hear about university endowments being scrutinized or praised, remember that behind those numbers lies a complex tapestry of financial planning and strategic foresight shaping the academic landscape!

Types of University Endowments and How They Work

When it comes to university endowments, understanding the types and how they function is like unraveling a financial puzzle. Universities in California, much like other institutions, categorize their endowments into three main types: quasi, true, and term endowments. Quasi-endowments are typically unrestricted funds that the university can freely use, while true endowments have a principal amount that must be maintained in perpetuity. Term endowments offer more flexibility as the principal can be accessed after a specific time frame or event.

Unraveling more layers of this financial mystery, let’s take a closer look at how these endowment funds operate. University endowments act as long-term investment vehicles where the principal amount remains intact while the investment income is utilized to support various programs or initiatives. The successful management of these funds plays a vital role in ensuring continuous financial support for academic endeavors such as scholarships, faculty positions, research projects, and infrastructure improvements.

One common misconception worth untangling is the idea of withdrawing money from these sacred financial vessels known as endowment corpus. Often referred to as “invading the corpus,” withdrawing funds from the core capital is usually restricted unless authorized by specific governing boards. It’s like trying to crack open an ancient treasure chest – only possible with the right key!

So next time you hear about university endowments and their intricate workings in California or elsewhere, remember that these financial assets serve as pillars supporting academic excellence for generations to come. Dive into the world of endowments with curiosity and enthusiasm; who knows what hidden gems you may uncover along this financial journey!

- University endowments in California are managed through unitized investment pools, where each endowment holds units that are revalued monthly.

- Withdrawing money from the corpus of an endowment, known as “invading the corpus,” typically requires approval from the board.

- Stanford University utilizes its $36.5 billion endowment for various purposes like faculty salaries, research endeavors, and athletics.

- UCLA boasts an impressive $7.7 billion endowment fund as of 2023, showcasing its financial strength.

- Common types of university endowments include quasi, true, and term varieties, each offering unique features akin to different flavors at an ice cream parlor.

How are university endowments in California managed?

University endowments in California, whether held by The Regents or by a campus foundation, are accounted for using a unitized investment pool. Each individual endowment owns units in the pool, revalued at each month-end.

Can you withdraw money from an endowment?

Withdrawing money from the corpus of an endowment, also known as “invading the corpus,” is generally prohibited for nonprofits without specific authorization from the board.

How does Stanford University utilize its endowment?

Stanford University’s endowment, valued at $36.5 billion, is used for payments serving various sectors of the University, including faculty salaries, research, and athletics.

What is the value of the UCLA endowment?

The endowment of the University of California, Los Angeles is $7.7 billion as of 2023.