Understanding University Endowments in 2021

Oh, the mysterious world of university endowments in 2021! It’s like having a money tree that keeps on giving… but not all at once. Let’s unravel this financial marvel and peek behind the curtain of academia’s financial magic!

Understanding University Endowments in 2021

So, picture this: Endowments are like funds donated to universities and other non-profits, kind of like a savings account on steroids. These assets grow over time through smart investments, and only a small chunk (usually around 4% annually) gets spent to support the organizations’ missions. It’s like having a piggy bank that keeps growing while you can only use a tiny bit each year.

Breaking Down How Endowments Work

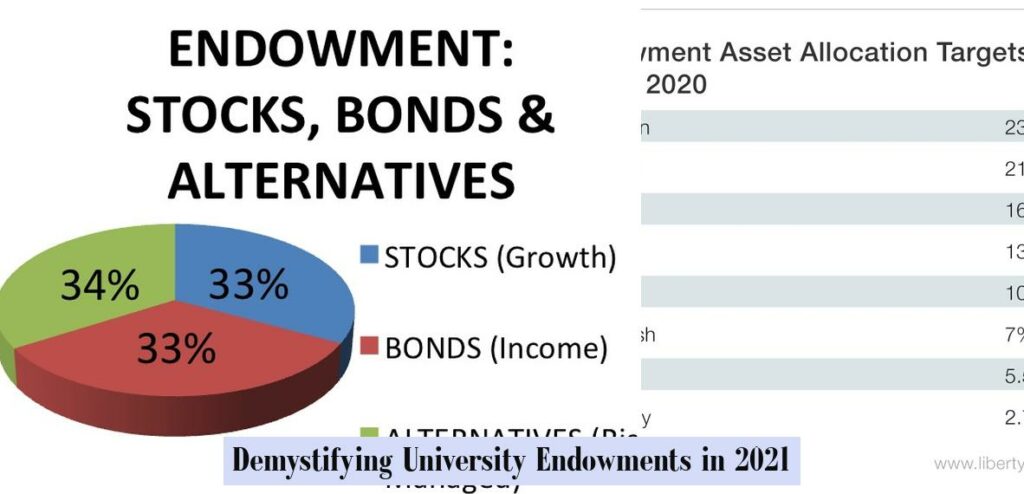

Alright, let’s delve deeper. When someone donates to an institution, that money gets invested to generate continuous revenue year after year. The idea is to keep the principal amount safely invested while tapping into the generated income to fund various needs like operations or capital projects.

Practical Tips and Insights

Did you know that endowment spending policies are crucial for maintaining the balance between honoring donor intent, supporting organizational missions, and managing financial needs? It’s like having a strict budget but with a long-term vision in mind.

Now, here’s a fun fact: The University of Toronto reigns supreme in Canada with its whopping $3.2 billion endowment fund as of April 2022. That’s some serious financial muscle flexing!

Interactive Element

Imagine you had your own mini endowment fund – what would you prioritize spending on each year? Maybe pizza Fridays for everyone or building futuristic robot classrooms?

Keep this engaging journey going by diving into more juicy details ahead! Trust me; it only gets more intriguing from here!

| Fact | Description |

|---|---|

| 4% Rule | Retirees can withdraw 4% of their savings annually to make their nest egg last at least 30 years. |

| Endowment in Canada | An investment fund set aside for the long-term support of a charity where only the income is spent. |

| Largest Endowment Fund in Canada | The University of Toronto has the largest endowment fund in the country, sitting at $3.2 billion as of April 2022. |

| Spending Policy | Determines how much an endowment can withdraw from its portfolio to fund operations and projects. |

| Endowment Function | Act as a self-sustaining source of funding by not paying out the entire fund balance. |

| Financial Endowments | Donated funds invested to create a lasting revenue source year after year. |

The Importance and Role of University Endowments

The Importance and Role of University Endowments:

University endowment funds play a crucial role in sustaining the financial health of higher education institutions. They serve as a vital source of revenue supporting various essential aspects such as teaching, research, and public service missions within colleges and universities. These funds are typically established through charitable donations, forming an enduring pool of investments aimed at generating sustainable income for the institution’s specified purposes.

Understanding How University Endowments Work:

Endowment funds are essentially everlasting pots of wealth that originate from generous donations. Academic institutions carefully invest these assets to ensure long-term growth while only tapping into a small portion annually to meet operational needs and advance their core objectives. By maintaining a balance between preserving the principal amount intact and utilizing generated income wisely, university endowments create a self-sustaining cycle of financial support.

Challenges in Managing University Endowments:

One common challenge faced by universities is balancing the need to honor donor intent while also addressing evolving organizational requirements. It’s like navigating a financial maze where institutions must strategically allocate funds to align with both the original donors’ wishes and current institutional priorities. Additionally, establishing effective spending policies is key to managing endowments responsibly, ensuring that withdrawals support operations sustainably without compromising long-term financial stability.

Insights into Canadian University Endowments:

Canada boasts several prestigious universities with significant endowment funds, with the University of Toronto leading the pack at an impressive $3.2 billion as of April 2022. Institutions like McGill University, the University of British Columbia, and the University of Alberta also feature prominently on this list with their substantial endowment holdings. These funds not only underscore these universities’ financial prowess but also underline their commitment to long-term sustainability in supporting academic excellence and innovation.

So there you have it – university endowments are more than just financial assets; they represent a legacy of generosity shaping the future of education. From funding scholarships to supporting groundbreaking research, these endowments are like invisible superheroes silently empowering academic endeavors! Feel free to ponder what innovative projects you’d back if you had your very own university endowment fund – maybe investing in robot teaching assistants or creating a pizza-topping scholarship for aspiring culinary students? The possibilities are as endless as an ever-growing money tree!

A Closer Look at Canadian University Endowments

Let’s dive into the enchanting realm of Canadian university endowments! Picture this: a financial treasure trove that keeps on giving, supporting essential endeavors in higher education. The University of Toronto leads the pack in Canada with its jaw-dropping $3.2 billion endowment fund as of April 2022, setting a gold standard for financial prowess among Canadian universities. Alongside UofT, institutions like the University of British Columbia, McGill, and the University of Alberta flaunt their billions, showcasing a league of extraordinary endowment funds that power academic excellence and innovation.

In Canada, university endowments operate like evergreen money trees – nurturing and growing assets over time to sustainably support educational missions. These funds are carefully managed to ensure longevity by reinvesting earnings while strategically allocating only a fraction annually to fuel operations and advancements. By honoring donor intent and aligning with organizational goals, these endowments play a vital role in shaping the future of education.

One common misconception is that university endowments are just static pots of money sitting idly by. In reality, endowments work tirelessly behind the scenes, acting as silent benefactors supporting critical aspects like student scholarships, cutting-edge research endeavors, and innovative academic programs. They play a pivotal role in ensuring that institutions can thrive financially while staying true to their missions.

As we unravel the mysteries surrounding Canadian university endowments, it’s fascinating to delve into how these financial lifelines sustain educational landscapes for generations to come. So next time you walk past those grand university buildings or witness groundbreaking research breakthroughs – remember, it’s all powered by the enduring legacy of these remarkable endowment funds!

- University endowments are like funds donated to universities and non-profits, acting as a savings account that grows through investments, with only a small portion (around 4% annually) being spent to support missions.

- Donated money is invested to generate continuous revenue, with the principal amount kept safe while the generated income is used to fund various needs like operations or capital projects.

- Endowment spending policies are crucial for balancing donor intent, organizational missions, and financial needs, akin to managing a strict budget with a long-term vision.

- The University of Toronto boasts the largest endowment fund in Canada at $3.2 billion as of April 2022, showcasing significant financial strength in the academic realm.

What is the 4% rule for endowments?

The 4% rule states that if retirees withdraw 4% of their savings annually, adjusting for inflation, their nest egg will last at least 30 years.

How do endowments work in Canada?

An endowment in Canada is an investment fund set aside for the long-term support of a charity, where the principal remains invested, and only the income, or a portion of it, is spent.

What university has the largest endowment fund in Canada?

The University of Toronto, established in 1827, holds the largest university endowment fund in Canada, valued at $3.2 billion as of April 2022. Other universities like the University of British Columbia, McGill, and the University of Alberta also have substantial endowment funds in the billions.

What is the spending policy of a university endowment?

A spending policy determines the amount an endowment can withdraw from its portfolio for funding operations, capital projects, etc. It should honor donor intent, support the organization’s mission, and reflect its financial needs and condition.